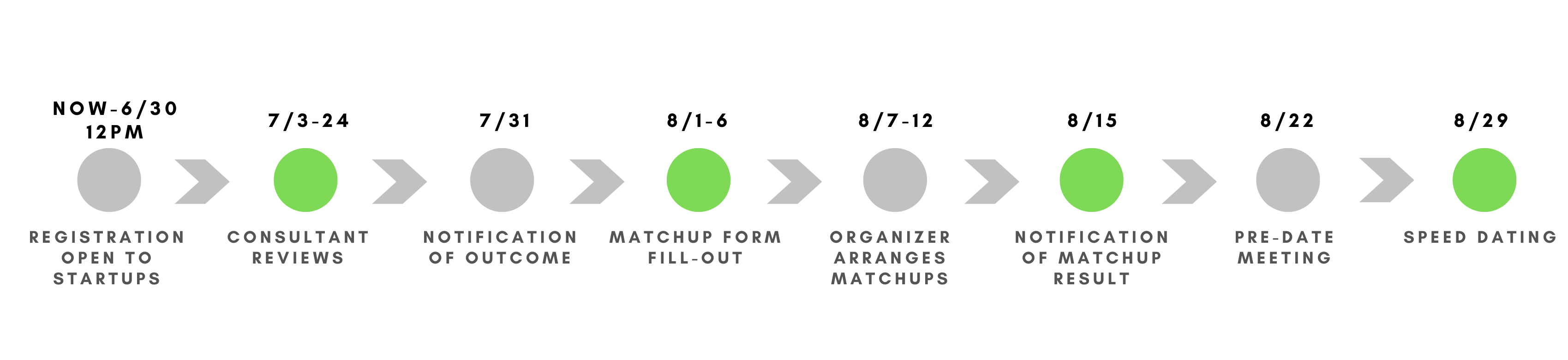

SCHEDULE & STEPS

Our organization

was established in December 2020 with a primary focus on financial

commodity investing operations. We take pride in having an extraordinary

management team committed to the long-term viability and growth of

the business we operate.

Barry Lin / Consultant

Larry Lai

Portfolio

Fields of Investment

High-tech applications, Innovative technologies, New energy, Green

energy, Biotechnology and medical materials.

Investment Rounds

Series A

AVA have an

angel club and an early-stage fund. Through systematic collection

of a wide range of case sources, each angel investor can discuss in

depth, and gather the resources of angel investors to improve the

overall evaluation ability and increase investment influence. The

AVA management team assists in the evaluation of investment projects

and post-investment management, so that each investment case can achieve

the best return.

JJ Fang / Founder / CEO

Portfolio

FST Network, Vocus, Moovo,Rosetta.ai, Conflux Yacht, Mr. Living,Lypid

Fields of Investment

AI, IoT, big data, internet, software, e-commerce, education

Investment Rounds

Seed to series A

Avalokitesvara

Capital focuses on investing in companies in the growth stage, combining

industry complementary resources to assist the company's growth, and

particularly focusing on the combination of market access and strategic

partners.

Pascal Huang / Director

Portfolio

Tai Twun Enterprise Co., Ltd., Danotech Co., Ltd., Azoo Bio Corporation,

Oxygen Technology Co., Ltd., Advanced Healthtech Biopeptide Laboratories

Co., Ltd., Joy-team., Jovita Group Inc., Fitgames, Pinkoi, Pakku Nutrition

Co., Ltd., Seeing Display Technology, Accurate Meditech Inc

Fields of Investment

ICT, IoT, Medical Material, Cultural&Creative Industry

Investment Rounds

Seed and Angel and series A

Since 2017,

CDIB Capital Innovation Accelerator Fund has been engaged in building

an investment portfolio targeting startups of cloud computing, IoT

(Internet of Things), mobile internet or next-generation e-commerce,

while offering resources and services through the CDIB Capital Innovation

Accelerator (“CCIA”) platform.

John Kan / Assistant Vice President

Portfolio

FunNow, Greenvines, Shopline, Hawooo, Autopass

Fields of Investment

Cloud service, IoT, mobile Internet and next generation e-commerce

Investment Rounds

pre A to series A(There are also a few new ventures that can be invested

in angel rounds or seed rounds)

Founded in

2014, Cherubic Ventures is a global seed-stage fund investing in pre-product/market

fit companies. We are eager to partner with the most talented founders

audacious enough to make the world a better place, and support them

from the very beginning of their journey to the growth stage.

Our team sits across San Francisco, Shanghai, and Taipei. Some of

our notable portfolio companies include Hims & Hers, Calm, Flexport,

91APP, Paidy, and Tezign.

To date, Cherubic has a global network of more than 150 portfolio

companies, as well as 500+ founders, advisors, and institutional investors,

allowing us to provide top-tier support for founders on their startup

journey.

Fen Chen / Analyst

Portfolio

Flexport, Calm, Hims & Hers, PhotoMath, Paidy, BellaBeat, 91APP, HaHow,

Pinkoi, iKala, Health 2 Sync

Fields of Investment

SaaS, AI, E-commerce, Logistics, Healthcare, FinTech, Web3

Investment Rounds

Angel to series A

Chunghwa Investment

Co., Ltd. is a Corporate venture capital led by Chunghwa Telecom Co.,

Ltd. Chunghwa Investment mainly assists startup companies via strategic

investment and consulting, and connects with CHT Group's business

and product units.

George Lin / Manager

Portfolio

ioNetworks INC, imedtac Co., Ltd., Taiwania Capital、PCHOME ONLINE

INC.

Fields of Investment

smart city, AI, content, fintech, advanced manufacturing, eHealth,

metaverse

Investment Rounds

After pre-A

Cornerstone

Ventures mainly invests in digital teams, and is willing to see that

the team can use artificial intelligence and other new technologies

to affect the market. Cornerstone will prioritize start-up teams with

Taiwan links, including those with substantial operational performance

in Taiwan, Taiwanese start-up teams overseas, and international teams

planning to enter Taiwan.

Catherine Tai / Analyst

Felix Yang / Analyst

Portfolio

Shopback, FundPark, USPACE

Fields of Investment

Digitalization, artificial intelligence, financial technology, IoT

Investment Rounds

seed, series A-C

CSC Venture

Capital Corporation combines the resources of CSC Financial Group,

which is highly connected to the capital market. At the same time,

it has successful execution experience in venture capital and financial

advisors. Combined with group resources, it can provide the investee

company with long-term and stable financial resources and a complete

listing plan. , Professional counseling team, comprehensive distribution

channels and complete financial services, one-stop service from the

initial stage of corporate investment support to the subsequent stage

of corporate listing counseling.

Jason Chou / Executive Vice President

Portfolio

Fields of Investment

Semiconductor, ICT, TMT, IOT, New Economy, Biotech

Investment Rounds

Series A to Pre IPO

Foodland Ventures

is the VC & accelerator investing in the new generation of food tech

founders changing the global food industry with technology. With operations

in Asia and North America, we leverage our partnership with leading

F&B brands, industry partners, mentors, and investors. Helping startups

fundraise effectively while growing their business.

Victor Chen / Founder & CEO

Evelyn Sun / Program Manager

Portfolio

Botrista Technology, Lypid, Yo-Kai Express, Tsaitung Agriculture,

DOTDOT Global (Quickclick), KABOB Cloud, 3T GDS Technology

Fields of Investment

AgriFood Tech, including logistics, AIoT, Automation, SaaS, novel

ingredients and more.

Investment Rounds

Seed to series A

FSP Group is

one of the global leading power supply manufacturer. Since its establishment

in 1993, FSP Group has followed the management conception “service,

profession, and innovation” to continuously fulfill its responsibilities

as a green energy resolution supplier. With the combination of its

leading role in power supply technology and the cultivation of green

energy field, FSP Group now provides more competitive quality products

and makes itself the most reliable partner for customers, consumers,

and suppliers with joint creation of maximized values.

Wen Chun Yao / Spokesman/Executive Assistant to Chairman

Portfolio

Voltronic Power Technology Corp.,Taiwan Truewin Technology Co., Ltd.,

Oriental Union Chemical Corporation, Dong Yao Biotechnology co., LTD.,

Powerland

Fields of Investment

Power electronics, energy storage, electric vehicles, semiconductors,

sensor, image detection, payment flow and others

Investment Rounds

After series A

Golden Canyon

Venture Capital Investment Co.,Ltd is a 100% subsidiary of the listed

company Chien Kuo Construction Co., Ltd., and its main business is

to invest in unlisted companies with development potential.

Jonathan Lee / General Manager

Portfolio

Fields of Investment

unlimited

Investment Rounds

Expansion period

HIM International

Music is an independent record label and artist management company.

It focuses on investing in life and entertainment-related areas.

Roger Lu / Vice President

Portfolio

iCarry, BEAST KINGDOM, ECOCO

Fields of Investment

Life and entertainment related industries, cultural and creative performing

arts, new technology application, 5G application, XR application,

Gaming, and Sports.

Investment Rounds

Before IPO

Hive Ventures

invests in early stage teams, who seeks to develop the building blocks

of the SMART Hyperconnected world. Through data and technology; From

Taiwan to the World.

Yan Lee / Founding Partner

Portfolio

Canner, PicSee, Botrista, ProfetAI, InstillAI, InfuseAI, IsCoolLab,

KryptoGO

Fields of Investment

AI, Big Data, IoT, SAAS, Blockchain

Investment Rounds

Seed to series A

Intellectual

Property Innovation Corporation (IPIC) is a new venture which is spinoff

from ITRI. Operating as a wholly owned subsidiary of ITIC, IPIC aims

to help capital investment of the domestic startups or enterprises,

provide patent analysis service, assist researchers commercialize

their invention, and enhance industry competitive advantage. Services

include diversified capital investment and integrated IP management.

Xiao Zhen Wang / Assistant Manager

Portfolio

Seer Microelectronics, Inc., Taiwan Electron Microscope Instrument

Corporation, KNCKFF Co., Ltd., InterAgent Co., Ltd., Orion go Co.,

Ltd., Phoenix Pioneer technology

Fields of Investment

All kinds of early technology

Investment Rounds

Seed, angel round

LUCIMA is an

investment company specializing in primary (VC and PE) and secondary

markets (US/Asia equities). Our venture investments span Healthcare,

Telecom, Technology, Green Energy, and SaaS.

Fion Yen / Assistant

Portfolio

WISH MOBILE、GREEN SHEPHERD、VERYBUY)、PT CEMERLANG MULTIMEDIA

Fields of Investment

AI & Data Intelligence、AR/VR、Green Energy、Connecting Device & IoT、Mobile

Application、Digital Content & Experience Technology、Martech & New

Commerce、Cool ideas & New Business

Investment Rounds

Pre A to Series B

Founded in

2019, Paragon Investment Corporation is venture capital firm focusing

on early-stage tech companies. We invest in digital technologies and

innovations such as Big Data, AI, Software in Taiwan, China, SEA,

and North America, typically at the Seed to Series A stage.

Our team has diversifying expertise, experience and connections with

industries, dedicate to capitalize, support and grow the portfolios

with resources and disciplines. Our vision is to help accelerate startups

go global and create sustainable value.

Michael Lo / General Manager

Doris Huang / Vice President

Alvin Tseng / Vice President

Portfolio

Yoda Pharmaceuticals, GoSky AI, PrecisemAb Biotech, Gemini Data, Evo,

GRAID, Lydia AI, Spaceship, International Accelerator

Fields of Investment

SaaS, AI, Big Data, Fintech, Biotech, Others(business model innovation)

Investment Rounds

Early Stage( Seed, Pre-A, A, B round)

Rich Fish Investment

was established in 2022. With the experience in blockchain-based start-ups

coaching at Asia Blockchain Accelerator and asset management of both

fiat and digital currencies, the founder, James Cheng, lead the Rich

Fish Investment strives to work together with the invested start-ups

to achieve success.

James Cheng / Founder/GM

Portfolio

MetaOne, SecuX

Fields of Investment

Cryptocurrency, e-commerce, biotechnology, healthy food, e-sports

entertainment

Investment Rounds

Seed, Angel

Saga Unitek

Venture is a professional venture capital and private equity fund

management company, specializing in investing in middle-market, growth-oriented

companies in China, Taiwan and the US. Our primary goals are to add

value to our portfolio companies and consequently deliver a better

return to our fund investors. We practice a hands-on approach. Each

of our partners has in-depth, hands-on experience in operating and

managing companies. Saga Unitek manages a sophisticated network and

framework of quality deal sourcing. The company consistently reviews

over 300 deals every year. We provide venture capital and growth capital

to fledgling companies with growth potential, proprietary advantage

in its chosen segment.

Alex Tsai / Vice President

Portfolio

Laster Tech Co., Ltd., Newmax Technology Co., Ltd., G-tank International

Co., Ltd., Yorkey Optical International (cayman) Limited, Unique Optical

Industrial Co., Ltd., Formosa Advanced Technologies Co., Ltd., Subtron

Technology Co., Ltd., Viking Tech Corporation, Leadtrend Technology

Corporation, Asolid Technology Co., Ltd., Health Ever Bio-tech Co.,

Ltd., Wegoluck Co., Ltd., Genovior Biotech Corporation, Gemini Data,

E-vehicle Semiconductor Technology Company Limited, Focaltech Smart

Sensors Co., Ltd., Focaltech Smart Sensors Co., Ltd., Alar Pharmaceuticals

Inc.

Fields of Investment

Biotech, Agriculture technology, optoelectronic, semiconductor, Internet,

Software

Investment Rounds

Angel, pre A, series A, series B and series C

Symbridge Machinery

Co., Ltd is an international trading company founded in Taiwan(R.O.C.).

Danfo International Trade Co., Ltd. in Shenzhen is a subsidiary of

Symbridge Group and has entered in Mainland China over 20 years. We

have more than 100 employees in Group and turnover of about EURO 30

Million per year. Our main business is International trade and exclusive

agent selling world trade hydraulic components and equipment. The

sales network covers all Taiwan and Mainland China; we are country-wide

hydraulic professional agent and stand on the leading position in

the field.

In 2017, Symbridge improves service and product line to our customers.

A new department, Intelligence automation is started. Our main products

are Universal Robots- collaborative robot and Nachi Robots- industrial

robot, and we dedicated to provide robot-related system integration

for customers.

Adam Chen / General Manager

Portfolio

Mbran Filtra

Fields of Investment

Smart Manufacturing, Water Treatment

Investment Rounds

Angel, Pre A, Pre B

TA Taipei Angels

Investment hopes to invest in the startup team as an angel investor.

In addition to providing appropriate financial support, the partners

in various fields of Taipei Angels can provide professional management,

market development, profit model, human resource planning, internal

control management, corporate governance, etc. Consultation and resources.

Vincent Lu / General Partner & Director

Portfolio

EpiSonica Corporation, Genovior Biotech Corporation, FunNow Ltd, SciKet(科研市集),

LumiSTAR Biotechnology, Inc., Sightour, Inc., AnHorn Medicines Co.,

Ltd., Tensor Tech CO., LTD

Fields of Investment

Biotech & CleanTech, Cultural Creativity Industry, Mobile & Commerce,

Software & Services, Technology & Hardware.

Investment Rounds

seed, Angel and series A

Taiwan Mobile

Co. (TWM) is a leading telecom operator providing mobile, fixed-line,

cable TV and broadband services.

Ken Chang / Manager

Portfolio

91APP, Cloudmile, LineMan, Soundon, Carsome, 17Live

Fields of Investment

eCommerce, cybersecurity, cloud, AI

Investment Rounds

Series B to Pre-IPO

In order to

drive domestic investment energy and enhance economic growth momentum,

the National Development Council combined with private forces to establish

the "Taiwania Capital Management Corporation". The company has raised

two funds-"New Technology Fund (Taishan Buffalo)" and "Biotech Medical

Fund (Taishan Buffalo No. 2)".

Andy Ho / Senior Investment Manager

Portfolio

Kdan Mobile Software Ltd., DCARD TAIWAN LTD., ANNJI PHARMACEUTICAL

CO., LTD., EirGenix Inc., SyneuRx International (Taiwan) Corp., Canner,

Inc., URSrobot AI Inc., Tantti Laboratory Inc., Cognito Health Inc.,

MECHAVISION INC., Ubiik Inc., etc.

Fields of Investment

IoT, Biotechnology and Medicine

Investment Rounds

Early to Extension Stage

Ta Ya Enterprise,

the Company's former entity, was founded in Tainan City. 1967 - Changed

name to Ta Ya Electric Wire & Cable Co., Ltd., and began production

of magnet wires in addition to high-voltage rubber-insulated cables.

1986 -Relocated to the current address at Kuan Miao Dist. With a headquarter

in Taiwan, Ta Ya has since begun constructing production facilities

in China and Vietnam. In the last 60 years, the Company was fortunate

to have a team of employees who worked diligently with mutual benefit,

and who are constantly exploring and seeking diversification into

new businesses.

Even Teng / Director

Jason Teng / Manager

Portfolio

Bora Pharmaceuticals, WinWay Technology, Txone, Tensor Tech, Fullhope

Biomedicsl,TE pharma

Fields of Investment

Biotech & Clean Tech,Cultural Creativity Industry, Mobile & Commerce,

Software & Services,Technology & Hardware

Investment Rounds

seed, PreA, Series A

TBB Venture

Capital Co., Ltd. was established in 2018, it is a 100% owned subsidiary

by Taiwan Business Bank. Our purpose is to introduce the concept of

“Mezzanine Finance”, which is while banks provide SME financing services,

TBB VC participate in investment at the same time. We hope this can

create an additional channel that assist SMEs to btain funds needed

for corporate transformation and innovative upgrading. Looking for

co-assist more potential unicorns start-up.

James Lai / Senior Investment Manager

Alan Lin / Investment Manager

Portfolio

EirGenix, Pinkoi, Lungteh, Locus Cell.

Fields of Investment

We followed the “Five Plus Two Industry Innovation Plan” promoted

by the Taiwanese government, which mainly focused on “Semiconductors”,

“Biomedicine”, “Carbon Neutrality and New Economic Impetus”, and other

industries that are encouraged by the relevant policy.

Investment Rounds

Angel round、A round、B round、C round

TFB Capital

is a venture capital company which is wholly owned by Taipei Fubon

Bank.

Loren Wu / Investment Associate

Wiki Liu / Investment Associate

Portfolio

8 investments in fintech and smart manufacturing in Asia, America

and Africa

Fields of Investment

FinTech and the “Five Plus Two Industry Innovation Plan” promoted

by the Taiwanese government

Investment Rounds

Series A to Pre IPO

With more than

$1.2 billion under management, TTVC also manages government-aided

equity to invest innovative companies and catalyze enterprise development.

Our investment portfolio covers a broad spectrum of technologies and

markets such as IT, healthcare, consumer product, and material sciences

sectors.

Jerry Chen / Director

Portfolio

91APP, Bafang Yunji International Company, AnnJi Pharmaceutical, Steminent

Biotherapeutics, Inc., Somnics, Inc., Yun Yun Ai Baby Camera Co.,

Ltd., Pressplay, Hahow, Backer Founder

Fields of Investment

New economic , AI, biotechnology, medicine and health-related industries

Investment Rounds

Series A, series B and seriesC

UMC Capital

was established in 2001 and is a corporate venture capital (Corporate

Venture Capital) in which UMC Corp. holds 100% of its shares. The

funds managed by UMC Capital belong to a sustainable fund structure.

In addition to providing consulting and planning services for venture

capital, it has investment bases in the United States, China and Taiwan

around the world, and provides corporate innovation through strategic

cooperation, investment and mergers and acquisitions. The advantages

of the solution, work hand in hand with the entrepreneurial team to

achieve success, and continue to provide new drivers of corporate

innovation and growth.

Tsung Lin Tsai / Assistant Manager

Portfolio

Appier, Dcard, Hahow, Reed Semi, NeuroBlade, Ramon Space

Fields of Investment

Semiconductors, early technologies (unlimited fields)

Investment Rounds

unlimited

Founded in

1951, the United Daily News Group (UDN Group) has chronicled news

and history made each day for more than 70 years. Looking forward,

the UDN Group continues to move to digital convergence for sustainable

operation of its journalistic endeavors, aiming to make Taiwan a better

place.

GaviannTseng / Investment Manager

Portfolio

Funiverse Co, L'elan Enterprise CO, WritePath, ikala, GoodDeal, koodata,

ischool , LaVidaTecCo

Fields of Investment

Tier 1: Healthcare、AI

Tier 2: Cultural and Creative/IP、financial data

Tier 3: Curate、education、audio/video

Investment Rounds

PreA to Series B

Walden International

was established in 1987 and is headquartered in San Francisco, USA,

with offices in Taipei, Silicon Valley, Singapore, Beijing, Shanghai,

India and Israel. Walden International manages more than US$2.6 billion

in funds worldwide, with more than 500 investee companies in 12 countries,

and successfully listed on 15 stock exchanges.

Samantha Lee / General Manager Special Assistant

Portfolio

Aquantia Corp., Berkeley Lights, Inc., Bolb Inc. ,Calysta Energy Inc.,

CNEX LABS, Inc., DSP Concepts Inc., ETA, Compute, Inc., Innovium,

Inc., Inphi, Corporation, InSense Inc., Lion, Semiconductor Inc.,

LucidWorks, Inc, MEMS Drive Inc., Mojo Networks, NOD, Inc., Paxata,

Inc., Shakr Media Co., SugarCRM Inc., Synacor, Inc., VeriSilicon,

Holdings Co., Ltd., Volta Industies LLC

Fields of Investment

Semiconductors and Electronics, Clean Tech, Health & Life Science,

Consumer, Internet & Digital Media and Software, Emerging Technologies

Investment Rounds

Seed , early stage and expansion stage

Wistron Corporation

focuses on Information and Communications Technology (ICT) products,

provides customized product development and services, and is a global

leader in the ICT industry. In recent years, Wistron has used its

strong R&D and technological innovation capabilities, and the growth

and development driven by diversified product development, to develop

portable computer products, desktop computer systems, servers and

network storage devices, display products, communication products,

and After-sales maintenance services. Wistron has also actively expanded

into the cloud business, display vertical integration-related businesses,

and the green resource business of disposal and regeneration of electronic

products after the disposal of electronic products, and has become

a pioneer in providing innovative technology services (Technology

Service Provider, TSP).

Alex Chiu / Director

Peter Pan / Director

Jack Hsu / Manager

Billy Liu / CVC Office

Portfolio

Fields of Investment

AIoT, big data, intelligent manufacturing, SW/FW system integration,

optoelectronic, electronic components / motors, precision instrument,

computer and computer peripherals

Investment Rounds

Angel, pre-A and series A